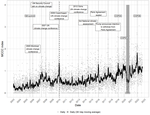

2023 Update on the Media Climate Change Concerns Index

Update of the Media Climate Change Concerns (MCCC) index! The index ranges now from January 2003 to August 2022. The MCCC is constructed from major U.S. newspapers and newswires to proxy for climate change concerns.

Our research published in Management Science

Our paper Climate change concerns and the performance of green versus brown stocks is now available online in open access at Management Science!

Check out the paper on this index!

Café Scientifique IVADO

David Ardia presented recent research projects at Café Scientifique IVADO.

Thanks to Alaa Kassem, Thien Duy Tran, and Clément Aymard for their participation!

Webinar at Ran.Données 2022

David Ardia presented a one-hour webinar about Science ouverte at the IVADO Ran.Données 2022.

Slides are available here!

Landscape of academic finance

The preliminary version of our paper Landscape of academic finance with the Structural Topic Model has just been released.

Using the structural topic model, we present a landscape of academic finance.

Sentometrics presented at the IVADO Digital October 2021 conference

The Sentometrics field was presented at the IVADO Digital October 2021 conference.

Virtual poster at the EC2 conference

Our paper Climate change concerns and the performance of green versus brown stocks was presented at the EC2 2021 conference.

Have a look at the video!

Check out the paper on this index!

Update to the Belgian (French and Dutch) EPU Index

We have made an update to the Belgian Economic Policy Uncertainty index.

This update makes the index much more localized to Belgium and thus less affected by international events (that have no impact on Belgium).

A French introduction to Sentometrics published in CScience.ca

The Sentometrics field is introduced in French in CScience.ca.

Check out the papers and the indices discussed in the article !

Ardia, D., Bluteau, K., Boudt, K., Inghelbrecht, K.

Our research featured in The New York Times and Les Affaires

Our research on climate change concerns and financial markets has been featured in The New York Times and Les Affaires.

Check out the paper on this index!

Ardia, D.